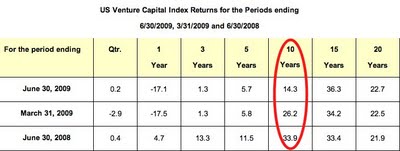

The best quarter ever was the last three months of 1999 when the end-to-end return to fund investors was 83.4%. To see what is likely to happen to the 10-year return, look at the nine-year return as of June – it was minus 5.2%.While people who track venture fund returns have been expecting this, the 10-year figure is widely followed and its decline can only add to the perception that venture capital is not what it used to be.Below are a chart from VentureBeat that highlights the issue as it's changed over the past twelve months. The trend is clearly not in the right direction.

Although I definitely agree that too many VC funds have gotten too large and that the resulting arithmetic seems unlikely and challenging, the asset class is far from broken.

This is a slight different representation of similar data.

Asset managers can pick from a variety of different asset classes, and portfolio theory tells us that we should diversify. However, had I not invested in the venture asset class ten years ago, and instead invested in the major equity indices, I would not be better off. Below is the NASDAQ performance over exactly the past 10 years.

And, here is the performance of the Dow Jones Industrial Average, the S&P 500, and the NASDAQ on a different scale.

How can you tell me that the venture asset class is broken without providing an alternative? Performance is relative, unfortunately some might say, so looking at one product's performance in isolation is not an appropriate way to evaluate a portfolio strategy.

More importantly, as it relates to the venture capital asset class, at the end of the day, it's very much a cottage industry run by human beings who manage different strategies and investment tactics. When evaluating venture capital performance, interesting data might be to better understand how fund size over the past ten years has affected returns and likewise geographic focus has affected performance. Other evaluation criteria could/should include sector focus as well (life sciences versus software versus clean tech, etc). I bet that several of these three criteria have as much to do with performance as vintage year, just as capitalization (size; large cap, small cap, etc) and industry (industrials, technology, healthcare, etc) impact public equity indices differently.