Plus, in addition to the roll-up & consolidation opportunities, I still think that there's a lot of growth potential in the market. Now that thin clients are becoming all the rage, Internet penetration continues to grow globally, and broadband is becoming more prevalent, I can only imagine an explosion in units sold per average user (not only consumer, but also corporate). Over the longer term, I think Lenovo will have made out on this deal. So it goes.

PC Business is a Good PE LBO Fit

Plus, in addition to the roll-up & consolidation opportunities, I still think that there's a lot of growth potential in the market. Now that thin clients are becoming all the rage, Internet penetration continues to grow globally, and broadband is becoming more prevalent, I can only imagine an explosion in units sold per average user (not only consumer, but also corporate). Over the longer term, I think Lenovo will have made out on this deal. So it goes.

Commentary on NVCA Predictions

I love the themes; growth in international investing, community oriented funds, and success through new industries... So it goes."We see U.S. venture capitalists investing more overseas in 2005. This trend will grow as domestic investing gets harder and venture capital becomes more plentiful. But our experience over 36 years is that investing overseas is inevitably more difficult than investing at home. We think the more effective strategy for dealing with the growth of foreign markets is to invest in U.S. companies with innovations in materials, energy, consumer electronics, biotech, and medical devices that foreign markets will buy."

-- Bob Pavey, Morgenthaler Ventures, Cleveland, OH

"I expect to see a relative increase in the availability of venture capital in emerging markets over the next five years - spurred by multiple state fund of fund initiatives in these markets and an overhang of venture dollars in the top ten markets."

-- David Mann, Spring Mill Ventures, Bloomington, IN

"Virtually all of the returns in the industry over the past 40 years have come from the Information and Communications Technology (ITC) sector with capital spending in that sector growing at nearly 3x the rate of GDP growth. ITC capital spending now represents almost 40% of all capital spending and I expect it in the future it will it grow at or near the same level as the GDP. ITC is a mature industry! Venture capitalists must find new industrial segments which are growing at a significantly faster rate than the GDP. Is biotech the answer? Either that, or we VC’s will have to outperform the GDP through shear brilliance. If we don’t, returns for the industry will decline to match other investment options."

-- Bill Stensrud, Enterprise Partners Venture Capital, La Jolla, CA

Hispanics Tapping Capital Markets

- Hispanics, today, are the largest minority group in the United States representing nearly 40 million people (or 13% of the total population)

- Hispanic purchasing power today is of almost $670 million and is growing so quickly that by the year 2022, it is expected to exceed $2 trillion

- This US Hispanic market is roughly equivalent to the entire Mexican GDP and growing at emerging market speeds without any of the emerging market sovereign risk

But, from everything I've seen (there is desperately little data on the segment), there are only about 200 to 500 US Hispanic companies with annual revenues in excess of $25M. And, unfortunately, many of these are not in segments that are of interest to most PE funds. Other than Hispania Capital (out of Chicago) managing a $75M fund or RGG Capital (in Dallas) with $25M, there appears to be very little SME focused private capital available. So, given that most of the several thousand US Hispanic companies are sub-$25M in annual sales, and that there is a clear trend of increasing household income & purchasing power over the next decades, I might weigh most of my efforts in underfunded Consumer Goods & Food Products, Financial Services & Banking, and Retail, Hospitality, & Distribution businesses. Deal sourcing may be a little more of a challenge, but who said making money was easy.

Carving new informational networks, attitudes, and strategies will be vital for continuing to propel wealth creation in the Hispanic enterprise economy and bridging the gap for rapidly growing, capital-starved mid-size companies seeking to finance thriving businesses.Shouldn't this be done at the community level, fostering brand loyalty & economies of distribution, and where it matters most or where capital is most needed?

I have been actively involved with a handful of initiatives to address this untapped opportunity, and have plenty of data available if you're interested. Drop me a note if you'd like to chat.

Scoble Predicts 2005

1) Apple Computer will ship a computer that uses a pen and a digitizer that is combined with the screen. It won't, however, call this a "Tablet PC."

2) Several executives will get fired for NOT blogging. Why? Blogging helps get adoption and executives who don't get adoption will be cut. They might not be told it was for not blogging, but watch who replaces the execs who are ousted.

3) Several more people will get fired FOR blogging. Another one was reported today. Or worse yet, will get sued for what they write or do on their blogs. Blogging is dangerous business.

4) Tablet PC's will go mainstream. Froogle's #1 ranking is just a hint of what's coming.

7) Three things will join: cell phones. Hard drives. Skype. That convergence will get everyone to question whether the iPod has a future. Of course, if Steve Jobs has anything to say about it we'll probably be talking about the iPhone instead.

9) RSS will go mainstream. Why? Cause it'll be part of the browsing experience.

11) There will be a major disaster in 2005 and mainstream media will use citizen journalists in a new way to cover the disaster.

12) There will be several Fortune 1000 companies that build 24/7 blogging teams. Mostly for technical support reasons, but some for PR reasons to react to what Slashdot commenters write about their products at 3 a.m. right before the East Coast journalists wake up to start doing their aggregator runs.

16) An executive at a major company will retire "to have more time to blog."

Holiday IP Communications Reading

First, Bob Frankston, dabbles in thought on the next Internet and addressing issues.

Second, legendary David Isenberg, professes on the need to completely overhaul the Telecom Act & surrounding DC ideologies.

Some more intel on the SunRocket and praise for the ex-MCI team.

Long-Term Strategic Planning

Net2Phone Activity

Net2Phone Global Services delivers VoIP telephone services to businesses and consumers directly and through its global distribution network of over 500 resellers in over 130 countries, capitalizing on the growth, quality, flexibility and cost advantages of VoIP technologies.In reference to Om's analysis and Andy Abramson's post on the 3.1 % stake AOL Time Warner has in Net2Phone, I think this is fascinating. Almost 90% of Net2Phone's revenues come from outside the US, in markets in which Net2Phone is the leading VoIP brand for both small businesses & consumers. Their US efforts have been slow to materialize and lower profile than Vonage's, so I think this investment & potential partnership makes a ton of sense. AOLTW can gain international exposure in a new market and N2P gets a leading US MSO partner. Furthermore, mostly for reasons of tenure in the space, much of the Net2Phone technology is very advanced, proprietary & comprehensive, whereas many recent VoIP service providers have simply leveraged third party & open source infrastructure.

With over $100M in accessible cash, less than $35M in long-term debt & payables, the company has a lot of dry powder to fund marketing & sales. And, with the institutional backing the company has (Liberty owns about 40% and Howard Jonas owns about 40% of the outstanding shares; Institutions & Funds own a large percentage as well, the rest going to management and individuals) there should be no shortage of capital if need be.

Plus, from what I've gathered, NEA most recently invested in Vonage (a company ostensibly far from profitability & with significantly less in-house technology than Net2Phone) at about a $350M pre-money, equivalent to revenue run rate enterprise value multiple of 3.5x. The same Net2Phone multiple is less than 2.0x. Plus, Net2Phone's revenues are diversified across multiple markets, currencies, & regulatory environments. All things equal (which they're not), this is a compelling opportunity!

Disclosure & Liability: Neither the information herein nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities or any options, futures or other derivatives related to such securities. Further, I am in no way affiliated to Net2Phone, nor am I a registered investment advisor. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this blog and should understand that statements regarding future prospects may not be realized. Caveat Emptor.

Timing is Perception is Everything

Paul Saffo at the Institute for the Future has pointed out that in a two-year period, less happens than we would have thought, and in a ten-year period, more happens than we could have ever imagined.This is so absolutely true, and likely the one of the most difficult challenges to being a venture investor. Timing is everything, not only from an sales & product adoption perspective but also from a ROI angle. A 3x return in one year is a homerun, whereas a 3x return in eight years is less appealing. Predicting when to invest money in a given growth stage business and knowing when to jump on board just before the point of maximum increasing sales/adoption growth, to maximize returns, is an art mastered by only a few.

LP Restrictions on PE Funds

Today, he brings up one of my favourite topics - private equity fund focus! He specifically talks about Spectrum Equity Investors and their decision to cut their next fund target down to $1.5 billion from $2.5 billion. He points out that this move was likely due to two factors, both of which make lots of sense.

Hilarious! This second point (B) has always bothered me about the industry. I absolutely & wholeheartedly agreed with the need some level of specific 'allocation' requirements by LPs, but if a fund has performed in the past under one set of guidelines...let it be don't change the rules of engagement because you think it might be better. If it ain't broken, don't fix it (that said, I have no idea if Spectrum was/is broken).(A) Spectrum launched its effort within the same general time period as did new funds from Providence Equity Partners and ABRY Partners, two firms that share Spectrum's New England roots and media/communications investment focus. Providence also shares the occasional deal with Spectrum, which would cause many smart LPs to shy away from investing in both.

(B) Spectrum also has fallen a bit into what I refer to as the JPMorgan Partners trap, in that it often appears like it's trying to be all things to all people. JPMorgan Partners was a particularly egregious case of this, thanks to its generalized industry focus and yo-yo approach toward investment stage ("We're a VC firm that does LBO deals. No ,we're an LBO firm that does VC deals. No, we're the world's largest producer of multi-colored confetti."). Most LPs today seem to want specificity (as opposed to generality), which Spectrum has in terms of industry focus, but not in terms of industry stage (i.e., half the JPMorgan Partners trap).

Now, my opinion - I think that institutional investors should either require an extremely specific focus for their LP interests or provide them a flexible mandate. For example, let's assume you're managing $1 billion (raised in, say, late 2000) in capital that is supposed to be invest in the NY Tri-State area and in Series B sized rounds in IT companies. Your core investment period lasts for about 3+ years, all of which is (as we all know) defined by a pretty brutal recession, a horrific terrorist catastrophe, and the lowest level of IT spending seen in years. Does this make any sense? Absolutely not.

There were plenty of good opportunities during the past three years, but frankly most of them were not in this specific category. So, the well-paid investment analysts are tied because some institutional asset allocator wanted to check a box. Now that's really intelligent.

I've dabbled on this issue back in April and earlier this month. That said, I do believe that certain focus can make sense; the type of portfolio company client focus that ComVentures has with telecoms, FTVentures has with financial services, or Carlyle has with the Department of Defense.

More on this subject later...

Pure P2P IP Communications is a Pipe Dream

I recommend reading the papers if you have the time. If you want the synopsis Aswath presents a succint review.

I've always found the argument for pure P2P IP communications to be rather unwielding. Agreed, much of it makes sense in theory, but in reality there are far too many implementation hurdles to overcome and legacy infrastructure to retrofit to. Unfortunately, the migration to IP communications is gradual (not instant) and must be flexible enough accomodate the least common denominator.

So, basically, the true vision of serverless P2P apps living at the extreme edge of the network is not practical in this world since the network will evolve faster than the majority of the possible endpoints. The functionality of IP communications is limited to it's weakest user, which today is average joe on the PSTN. Unfortunately, I think it may take a while for all 6 billion average joes to leave the PSTN. So, we'll just have to make do with hybrid until then. So it goes.

Maximizing Investment Theses

For Americans, the bear market is over. For Europeans, Canadians, Australians, New Zealanders and South Africans, the bear market grinds on. If we are right in our forecast that the Canadian dollar will reach par on the greenback by mid-2006, a Canadian holding an S&P Index Fund will need double-digit returns on the Index to earn what would be earned in a Canadian chequing account.

Global statistics on per capita GDP and per capita wealth tell us about incomes and net financial assets--but they are heavily skewed by the changing dollar values of local currencies. When the dollar went on a tear nine years ago, Americans' share of world wealth grew dramatically: Americans who kept all their savings on deposit with an American bank gained hugely in wealth compared with European and Canadian counterparts of equal wealth and savings who kept them in their own currencies with their own banks. The Americans' globally-adjusted wealth gains, just from cash, were so strong that they delivered comparable returns with foreigners who had balanced portfolios. Rarely was it so easy to achieve such huge investment out performance without assuming substantial volatility risk.

Based on the evidence of returns on financial assets from 1995 through January 2002, the stronger one's currency the better. "Sound as the dollar" was the mantra, as the world poured its savings into the US, the progenitor of the magic money machine, the New Economy, and the world's sole hegemon now that peace had broken out-- seemingly forever.

But a desirable level for a currency is not measured solely in terms of wealth. It is also measured in terms of the transactions of competitive economic activity. "Sound as the dollar" was the death knell for millions of American manufacturing jobs during that same time span. A company whose costs accumulate in the world's most expensive currency is at a punishing disadvantage in competition with competitors based almost anywhere else. In terms of global trade, a weak currency is a consummation devoutly to be wished. The currency lord giveth (in measurement of the value of people's savings) and the currency lord taketh away (in terms of employment income, and the value of employer pension plans).

In terms of mergers and acquisitions, changes in currency values produce a Pirandello-style role switch for acquirers and acquirees. During the 1990s, US multinationals were able to buy European and Canadian companies, using their valuable cash and their valuable stock to buy companies whose stock was denominated in a weak currency.

The game has changed. With the euro up from its low against the dollar by 60%, even if the relative share prices of an American would be acquirer and the Eurozone potential acquiree had remained in the same quoted relationship to each other, buying that Eurocompany would now cost the US company 60% more. Consider, for example Manulife's purchase of John Hancock: if the loonie had done what many prominent Canadians were predicting--fall to $0.50, Hancock would have been too costly for Manulife to buy. At some point in the loonie's plunge, the roles would have been reversed.

Another way currency changes can affect corporate power comparisons comes from the denomination of corporate debt. Consider two Canadian companies with roughly equal stockholders' equity as of early 2003. Each has substantial debt. One company has nearly all its debt in loonies, the other's is greenback-denominated. The second company's enterprise value rises sharply compared to the first company.

I'm not an Economist by any stretch of the imagination, but I do believe that this sort of issue is going to become more & more important to both individual investors and competitive venture investors during the next years. Globlisation, and the Internet, is making our world smaller and making capital more liquid -- free to flow wherever it might. Investment strategies & technology thesis must start take in to account the global marketplace and international competitive factors much more than they once did...

Another insightful excerpt from the read came from the Investment Recommendations section:

- all other things being equal, avoid investing in companies who produce what China produces;

- all other things being equal, invest in companies who produce what China needs to buy.

That seems simple enough.

Scalable Business

Smart startups have to think about how to take the friction out of their business model. Primarily that means looking at your value stack, and figuring out a way to take human beings out of your process that slow things down. The good news is that more and more customers hate dealing with people, as they are analog, slow, and imperfect. Some other more mundane examples: Dell product ordering, Walmart procurement, Intel and Cisco fufillment, online travel services, grocery self-service lines, and on and on.He doesn't necessarily suggest that taking the human out of the picture is the sole opportunity, but rather simply taking friction out of the system, creating value, and sharing it with the customer.

Effectively, Steve is championing the idea that huge homeruns are created by (a) having very scalable business models that (b) don't require much (if anything) to complete an advantageous sale and/or (c) enable mass customization. Products or services that require hefty sales forces and lengthy sales lead times are simply an enormous impediment to certain explosive growth. In an established market space, such as the one that Google broke in to, market scale was created by automating sales and enabling SME's to buy the same products that were only really available to large enterprises.

Skype has grown because it simplified VoIP across firewalls and enable NAT traversal. Intuit grew because it made software easy to use for the SME. Inphonic grew because it simplified infrastructure for wireless carriers and MVNO's. AOL exploded because it made the Internet easy. Microsoft took off because they made (after Apple's idea) the personal computer's GUI straightforward. Bloomberg boomed by making information instantly accessible. And on. And on.

Charlie & the Chocolate Factory

Inverted Yield Curves

In 1996, the New York Federal Reserve did a study on what indicators were the most reliable predictors of a recession. The only one of six indicators that was significantly reliable was an inverted yield curve. They later did a private study with over 20 factors and still the only dependable indicator was the inverted yield curve. I read the studies in 1999. (I later learned of Ph.D dissertation done by the very smart Dr. Harvey Campbell, now a professor at Duke, which pre-dated the Fed study, but came to the same conclusions. The Fed study clearly relied upon his earlier work.)

In a normal world, short term rates are lower than long term rates. This makes sense, as investors want to be compensated for the risk of the longer holding period. There are exceptions to this rule, and at times short terms rates rise above long term rates, giving rise to what is known as an inverted yield curve. Typically, when the yield curve is inverted or negative for 90 days, you get a recession in about 12 months. Actually, it is more than typical. In the US, every time we have had a period of negative yield curves, we have had a recession within a year.Thus, in August of 2000, as the yield curve in the US went negative, I predicted the US would enter a recession in the summer of 2001, and since the stock market loses an average of 43% in a recession, it followed that the stock market would tank. Quite the out of consensus call at the time. Although the NASDAQ was still in a swan dive, the New York Stock Exchange was climbing to within shouting distance of its previous high. The economy seemed to be moving along quite nicely. But the yield curve was staring us right in the face.

John goes on to point out that the US yield curve is flattening, it is nowhere near an inverted yield curve and not signaling a recession. However, he does point to an inverted yield curve in England. So it goes.

Sprint Nextel Merger

I've always been a fan of the wireless B2B model, selling to business customers, and I continue to believe that in the long run, this focus will be advantageous to the combined Sprint Nextel as the wireless market matures. There's clearly a further divergence between business wireless needs and consumer wireless needs, not only technologically but also service-wise.

Sprint's lead in rolling out a UMTS voice and high-speed data network gives it a nice little advantage in selling effective 3G services, whereas the new Cingular is only now getting started to build. The merged entity is going to have some hard work ahead, however, including completing the merger, combining the customer bases / billing systems, rolling out EV-DO, building dual-technology phones, and cleaning up the new organization. Andy Seybold thinks that "it will take until sometime in 2007 to accomplish all of this." I hope that's all it takes, not any longer. Right off the bat, I too, like Andy, would love to see Nextel begin offering higher-speed data EV-DO PC cards (from the Sprint service).

From a business perspective, I'm still very curious to see what happens with the folks over at T-Mobile in Washington & Germany. Om points to an article in Forbes about certain such rumours, including talk of Verizon bidding for Sprint. I wonder what the DoJ would think of that combination. Techdirt even points to an article in Business Week about Alltel's fate.

Joel on Software Pricing

When you're setting a price, you're sending a signal. If your competitor's software ranges in price from about $100 to about $500, and you decide, heck, my product is about in the middle of the road, so I'll sell it for $300, well, what message do you think you're sending to your customers? You're telling them that you think your software is 'eh.' I have a better idea: charge $1,350. Now your customers will think, 'oh, man, that stuff has to be the cat's whiskers since they're charging mad coin for it!'He goes on to suggest the importance of client segmentation, a dangerous but very common practice for large scale enterprise software companies.

Joel also presents a three way pricing model: free, cheap, and dear:

Free. $0 - $10, Open source, not relevant to the current discussion. Nothing to see here.The key concept Joel points out using this troika pricing model is that there's no software priced between $1,000 and $75,000. Basically, anything costing more than $1,000 is generally subject to a more comprehensive corporate approval. Read on, it's fun & insightful.

Cheap. $10 - $1,000, sold to a very large number of people at a low price without a salesforce. Most shrinkwrapped consumer and small business software falls into this category.

Dear. $75,000 - $1,000,000, sold to a handful of rich big companies using a team of slick salespeople that do six months of intense PowerPoint just to get one goddamn sale. The Oracle model.

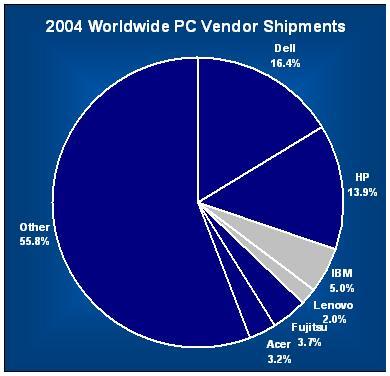

The Lenovo IBM Deal

Where were the major private equity players in this deal? I'm surprised KKR, Goldmach Sachs, Blackstone, Apax, Carlyle, TPG, Silver Lake, or Clayton, Dubilier & Rice didn't get involved.

A Word A Day Quote

Today's email had a quote that I thought was quite timely considering all of the heat that the US continues to get from Iraq and the interim government.

The spirit of democracy cannot be imposed from without. It has to come from within. -Mohandas K. Gandhi (1869-1948)

I thought we were liberating these people?!?!? How could Tenet and Bremer possibly be awarded with the Presidential Medal of Honor for their accomplishments?!?!? Are these even remotely in the same league as the likes of Martin Luther King Jr? Can one even credit them with success? This is bullshit.

I hope the troops in Iraq can find further stability & peace, and more than anything come home soon. It's funny how no one is balking at the fact that the US involvement is now clearly & statedly an occupation. I'd venture to say that management fell short of expectations that they themselves set. And, what's happened?Our enterprise value has tanked. Isn't it time for the Board to shake things up? This is just unacceptable.

German P2P Television

Unlike Napster, however, the German broadcasters would still be making money off of the Cybersky distributed content. Right? Well, the commercials would still be in place, and isn't that what generates most of the fees? You might argue that once digital, the commercials could be skipped or removed, but didn't PVR/DRV's already fight that battle?

This legal dispute is going to be much more interesting than the Napster one. I can't wait!

Can TiVo Learn From Apple

They were smart in teaming up with DirecTV as a channel to hugely boost their subscriber base, but the ARPU from DirecTV is significantly (and possibly detrimentally) less; $5 from DirecTV versus $13 direct. What's the point? That channel isn't sustainable (DirecTV will likely not renew in 2007) and those customers will have gained little attachment to the TiVo service.

Maybe there's better game to be played by separating the box from the service? Could someone from Apple please call the folks over a TiVo and share some "lessons learned?"

EDN opines on the November 22nd TiVo press release.

IP Based Television

VON Magazine discusses the VOD model and whether it could be an acceptable alternative or complement to cable (or satellite) TV delivery. What delivery model are RBOCs going to follow? What will consumers go for? Is FTTP a better focus as a long-term investment?

Voice as a Product or Service

He argues, rightfully so, that IP-based voice and video phones are merely products, not services. The services are in fact:

There is no effective difference between services needed for video packets or voice packets, other than potentially improved bandwidth QoS. But, marketing and pricing does not necessarily follow the same lines and technnical evolution. Take SunRocket's approach, for example.Directory service: the service provider informs the caller of the callee’s reachability address.

NAT traversal: the service provider facilitates NAT/Firewall traversal either by using UDP hole punching technique or by forcing the traffic pass through a network node.

The service provider carries the traffic on a QoS enabled network that is appropriate for the service.

We argue that pricing for services will become a la carte (products being virtually irrelevant) -- improved QoS being one of them (in addition to directory services, non-repudiation, device discovery, presence, voice, video, data, content, media, etc). Will I have a choice for Gold, Silver, or Bronze service differentiation? If so, I want Platinum, baby!

This argument has been preached before, but am not sure I bite on it just yet. Are consumers going to be able to adapt? The better question to ask, I guess, is: when will our habits change? Will it take a generation? Possibly less, it sure did for Internet service, moving from WYSIWYG America Online to slightly more complex DSL or Cable.

SunRocket's Simple VoIP

Telephony Executive Editor Vince Vittore examines SunRocket's concept of taking the technology out of VoIP--the company even calls the customer device a "Gizmo"--and marketing based purely on the simplicity of the end service.

Jeff Pulver Honored by DC Bar

Jeff mostly spoke about his background, endeavours, and excitement about VoIP. He opened with his background as a ham operator, then segued in to how software is changing the telecoms industry, the next industry to be shaken by the Internet is television, and how Moore's Law is impacting communications.

The discussion got interesting during Q&A as folks started asking about regulations and the general global consensus on the technology shift. Obviously, many of the people present in the room represented the Bells or CLECs, so there was a little bit of curious tension.

Jeff urged the US FCC to take the lead, one (obviously) of little regulation. He felt and suggested that many other governing bodies and PTTs would likely follow suit to the US' actions. I agree and believe that this is of quintessential importance as voice is a global application (as the Internet is a global service), bound by no one country or regulatory body. Freedom of evolution, and limited oversight, is essential to a successful network and to a useful voice utility for consumers. I hope that our bureaucrats and politicians do what's right, and don't get embroiled in short-term near-sightedness for the almight lobby...

The US Dollar & Chinese Yuan

Watch out folks for tempestuous markets. In the midst of a war, an energy crunch and a continuing telecom regulatory paralysis, Greenspan has joined the self-destructive Administration effort to force China to raise the prices of its exports to us. (Great idea, increasing the prices of all high-tech companies that depend on foreign components and skills. Disrupting the world's fastest growing importer and largest market for U.S. technology. Devaluing the U.S. economy.)Forbes has also published an article on dollar policy as it relates to the US and China. None of this volatility is good for any one, and it looks like no one is willing to step up to bat just yet.

Greenspan's delusional debacle of dollar bashing and deficit panic in Frankfort dispelled all hopes that he is somehow a supply-sider at heart. The key test of a 21st Century economist is whether he can grasp globalization. Nearly all trained academics and their disciples in politics fail the test. Unfortunately, the names cited to replace Greenspan, such as Bernanke, are even more delusional in their economics than Greenspan has become. Moreover there is not a single economic columnist in any major publication who has any idea what is going on.

Like nearly all establishment economists, these guys believe ardently in national economies, insulated from one another, exchanging goods and services

across their borders, with equillibrium maintained through gyrating of currency values. They treat money as their elastic plaything rather than as the standard of value--the clock and measuring rod--for the world economy. They retain the notion that foreigners holding dollars somehow pose a threat that is different from the threat posed by George Soros or a thousand hedge funds holding far more dollars than foreigners do. So Greenspan joins the chorus declaiming a fake deficit crisis and virtually calling on dollar holders to sell.

The result will be another stupid and unnecessary technology crash, continuing the current devaluation of U.S. markets as the dollar falls. The danger is that these setbacks will defer or compromise the aim of retrenching tax rates and regulations as blind politicians administer yet more self-destructive policies in the wake of their initial mistakes.

The incumbent monetary wizards treat the U.S. as if it were chiefly a producer of commodities purchased on price rather than a source of technological value-added largely based on imported components and devices. A cheap dollar policy is a cheap nation policy. Greenspan prefers to compete with third world labor and resource industries rather than to collaborate with first world innovators who use the best gear and resources from around the globe.

However, we try to steer clear of macromancy around here. Bad monetary policy creates panic and confusion in which shrewd stock picking can prevail. So let's contemplate a stock that can thrive over time regardless of the astrologers in charge of economic policy …

I fear that this is just the beginning of a long learning cycle, that we're all going to have to suffer through.

Pulver Predicts 2005

11) Open Source communications continues to gain momentum. The effects will be felt in 12-18 months.I hope that open source communications takes off, and all of the diverging parties can continue to move towards common standards. Let's not re-play the mistakes of the US wireless business and building proprietary networks.

16) If 2004 was the year of WiFi, then 2005 might be the year of Bluetooth. 2005 will see the emergence of the first dual, or multi-mode, phones capable of switching from WiFi to mobile wireless (and perhaps to landline).

Jeff may be right on about Bluetooth. After all, micropayment systems and infrastructure is now in place and we will likely Bluetooth as the primary medium for micro transactions -- that is, if the carriers play ball like adults. I'm not so sure where the value is in WiFi to Wireless switching... Are there that many WiFi networks covering areas that Wireless cannot? Are the WiFi providers capable of playing in the voice space, deliver the necessary QoS infrastructure? Is it really worth something to the end user?

US Enterprise VoIP Growth

I'd be willing to guess that Columbia Capital and M/C Venture Partners, the newest owners of the fully deployed and operations enterprise IP communications service ICG Communications, are in for a wild ride. After all, they paid a song for the company, and their timing was just about right.

Ray Ozzie on Organizations

The virtual office will shape our concept of the workplace. The new concept: a world of pervasive knowledge work, riding on the foundations of fiber laid by the ghosts of an Internet bubble past and enabled by cheap, self-service communications tools and technologies.

I'm curious how this ultimately impacts the economics of business and organizations. Will businesses start to resemble the pharma industry, where the brand is just that and innovation is acquired from others -- small groups of innovators working independently -- on the other side of the world. How will big business evolve and how will economies will handle trade & taxation issues? Some many questions, so many opportunities!

Thanks to Jeff Nolan for the main dish.

Haloscan Trackback

Consolidation of ISPs

New Enterprise Associates

Most venture funds split the profits of a fund, the most typical split being 80 percent going to limited partners and 20 percent going to the fund's managers. NEA, Barris said, makes the split 70-30.

Inside the firm, profits from a deal are spread out across the partnership; no one partner takes more than another in a single deal. That promotes a team atmosphere that is necessary in running a big fund, Barris said. In most funds, a partner who leads a successful deal gets a bigger cut of the profits than other partners.

Running a partnership in a democratic manner and sharing success compensation in a socialist way is probably the best way to run any such service business. I tend to subscribe to the philosophy that a whole is always better than the sum of its parts, and fostering genuine collaboration is best path to success. That said, according to most LPs I've spoken to, generally one or two partners in a partnership account for the bulk of the extraordinary returns in any given partnership. I don't know if this holds true for NEA.I wonder if NEA's LP's have a preferred return (hurdle rate) over the GP's 30 percent carried interest. I would really like to see that instrument become more commonplace in the VC alternative asset class.

The JigSaw Social Networking Biz Model

Thanks to Dan Primack from Thomson Venture Economics for a nice synopsis on the company plan and business model.

The question really is, not whether this would be a useful service, but rather whether the community's trust can be sustained. Nobody likes being called upon by sales people, and as the database becomes populated & used by sales agents, my phone will start ringing more. I'm not going to want that, and I don't know anyone who will. So... Isn't there the risk that this service ends up looking more like a Do Not Call Registry rather than anything else? Who knows? I guess it's worth the gamble for Norwest and El Dorado.

Economist Articles

Will tougher competition and increasingly demanding investors cause the industry to consolidate? Sir Ronald Cohen of Apax Partners thinks that over the next decade the private-equity industry will polarize. At one end, a few big global industry leaders will emerge — "maybe three or four dominant brands with high returns"; at the other, small specialist firms will thrive. In the middle, however, many firms will find it hard to compete. His prediction is plausible, and the losers may include some famous names.

Many have already stated this, but I think it's interesting to note it probably holds true across the entire asset class. Not only will buyout shops benefit from brand or specialization, but so should venture groups. With the increased complexity of technology, the maturing of the industry, and the globalisation of innovation; we are beginning to see this further stratification in to industry focus, geographic focus, and investment stage. As this continues to happen, the dominant brands will likely outperform the rest on an average basis as they can withstand & adjust to the changes in the economic over time.

We'll see, I'm still rooting for the little guy.